Mergers and acquisitions are a hot topic in the biopharmaceutical industry. With 2019 setting records in terms of deal value and volume for biopharmaceutical M&A, many question the purpose of these processes.

In addition to increasing shareholder value, management pursues mergers and acquisitions for a variety of reasons including innovation, synergy, and portfolio realignment. In terms of innovation, large pharmaceutical companies often purchase small companies with drugs in late stage clinical trials. A mutualistic deal, big pharma receives the benefit of adding a new innovative product to its pipeline while smaller companies are better able to navigate regulatory barriers. Adding new drugs to pipelines has reached critical importance for pharmaceutical companies as patent expirations allow generics to compete. When it comes to synergy, firms are able to streamline operations to cut costs. Additionally, firms that want to enter a new disease space will realign their portfolio through acquisitions.

Back in 2015, we conducted an analysis where we evaluated whether biopharmaceutical mergers and acquisitions drove growth. We analyzed AstraZeneca, Sanofi, Pfizer, Merck, and Roche. In summary, the number of new molecular entities and biologic license applications per year had decreased with no increase in shareholder value. Alternatively, when this was compared to the value of smaller biotechnology companies the difference was stark. The share value of the electronically traded fund (ETF) with a symbol of XBI that represents a bucket of biotechnology stocks, jumped by 65%.

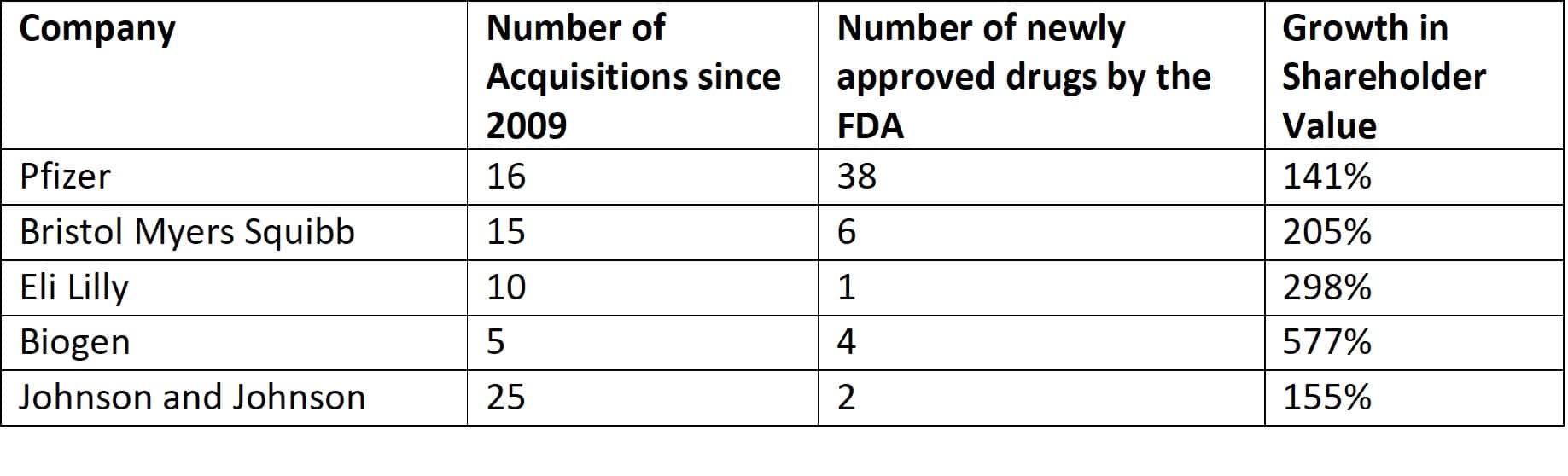

As the merits of biopharmaceutical M&A continue to make for an endless debate, I thought this would be good time for an update. I define shareholder value as [Basic Earnings Per Share (EPS) + Stock Price]*shares held. This time, I included Pfizer, Bristol Myers Squibb, Eli Lilly, Biogen, and Johnson and Johnson and analyzed them over the course of the latest economic expansion according to the NBER (2009—2020). Again, this basket of companies is compared to the ETF XBI that now holds 134 small cap biotechnology companies with high growth potential. In the tables below, I present my findings.

Shareholder Value

Examining the basket specifically, the companies with the least amount of acquisitions, Eli Lilly and Biogen, had the greatest growth in shareholder value. Pfizer, the company with the second most amount of acquisitions since 2009, had the smallest growth in shareholder value.

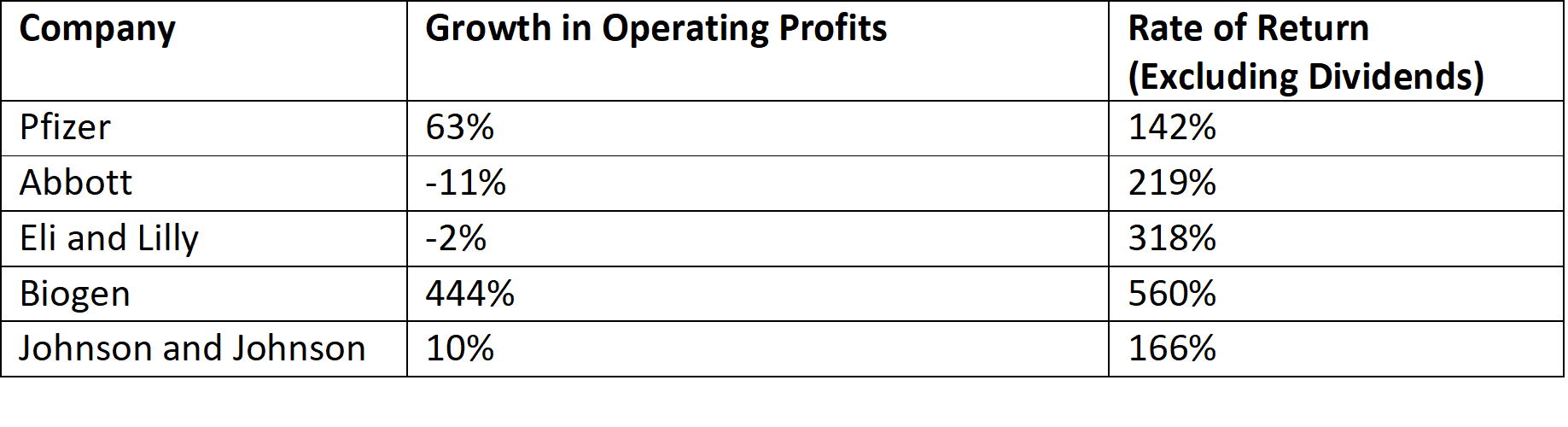

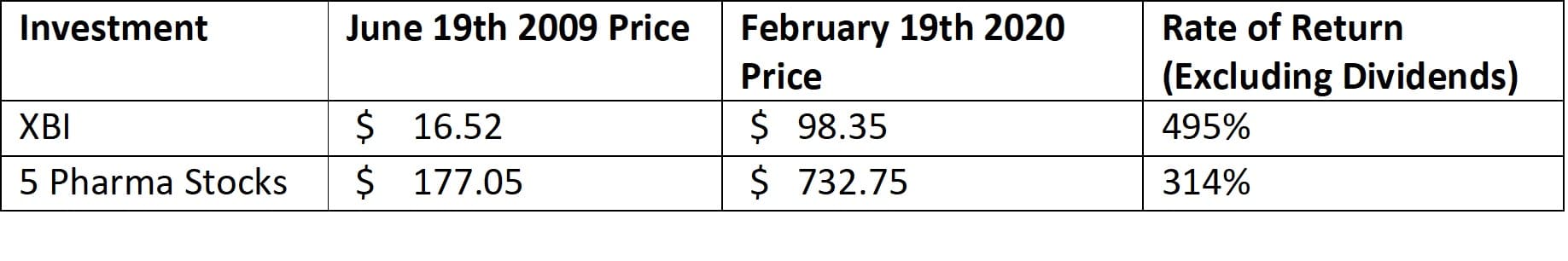

When it comes to rate of return, the story was the same. Again, Eli Lilly and Biogen were the best of the bunch. Again, Pfizer and Johnson and Johnson were the worst in the basket. However, when comparing the basket to the ETF of 134 stocks I mentioned earlier, the story changes.

What’s Changed

Since our last article, biopharmaceutical M&A and FDA drug approvals have increased dramatically. On the M&A front, the industry forged a total of 596 major M&A deals in the last decade. Likewise, the FDA has been approving more drugs, averaging range of 40-50 new drugs annually. However, things have not changed on the investment front as investors were again better off buying the ETF.

In terms of innovation, industry specialists still agree that mergers and acquisitions undermine research and development. Haucap et al (2016) cites that in addition to decreasing research and development from the merging companies, M&A activity decrease R&D expenditures of non-merging competitors—by more than 20% within four years after the merger. Haucap study highlights the ever-present trend that pharmaceutical companies are looking externally to innovate. The data supports this. According to a recent analysis of 2014-2018 FDA approvals, “the majority of new drugs approved originated or were initially developed by smaller biopharma companies.”

Alliances: A More Promising Alternative

In the age of COVID, pharmaceutical companies have forged various alliances in the race for a vaccine. In the U.S, the NIH brought together more than 12 leading biopharmaceutical companies to create a coordinated response to the pandemic. For example, AstraZeneca struck a deal with Oxford for the sole rights to their vaccine. We are seeing collaboration on other fronts such as Pfizer and BioNtech.

In contrast to mergers and acquisitions, studies have found alliances to more beneficial to a company’s research and development. Innovation is imperative in the time of COVID. The biopharmaceutical industry needs as many competitors as possible to spur innovation. A safe and effective vaccine depends on it.

Dave Fishman is President of Snowfish. Snowfish has been helping leading pharma, biotech and med device companies optimize their stakeholder networks for almost two decades. Reach out to Snowfish or info@snowfish.net, to learn about how our expertise can enable your team to partner your most important stakeholders.

- Market Access: The Latest Hurdle for Treating Alzheimer’s and Dementia - June 14, 2023

- Rare Disease Outreach a Missed Opportunity - November 7, 2022

- So You Read Our Previous Post on Biomarkers? - August 1, 2022